Loose diamond prices depend on carat weight, color, clarity, and cut quality, also known as the 4Cs. Consequently, diamond cut quality can influence prices by up to sixty percent. That is why the Rapaport Diamond Report states: "Prices for select excellent cut (in various sizes) may trade at significant premiums to the Price List."

Demand and supply dynamics also influence the diamond market and result in price fluctuations. Consumers must also consider the differences between natural and lab-grown diamonds. Then, there are the differences between white and fancy-colored diamonds, such as the rare and coveted blues and pinks.

With such a diverse range of diamond qualities and shapes available, it is essential to consult with diamond experts and dealers to navigate the diamond market and find the perfect diamond within your desired price range.

What affects diamond prices the most?

Most people assume that carat weight affects diamond prices most, which is true to some extent. Simultaneously, the overall cut quality can affect the price by up to sixty percent. Multiple factors influence prices in that case, and it's like figuring out a Rubik's Cube.

Most people know the Diamond 4Cs, Carat weight, Clarity, Color, and Cut quality, which describe the characteristics of the gem. It's difficult to say with certainty that one consistently impacts prices the most on the diamond price chart.

The Price Per Carat diamond value depends on a combination of all those factors and some that are less apparent. However, we can make some general observations that contribute to the difference in price:

Rapaport Diamond Price Report.

Carat weight

Generally speaking, larger diamonds are rare and cost more than smaller stones. In that case, a 2-carat diamond costs more than a 1-carat diamond, assuming all other factors are equal.

Diamond prices are not linear, but price lists show increases at specific intervals, such as between 0.99 and 1.00 carats. Simultaneously, incremental increases occur between the published ranges of price per carat (PPC).

For example, the price lists state the PPC for diamonds weighing 1.00 and 1.49 carats as a specific amount. Meanwhile, premiums are applied over the "wholesale cash asking price" for more desirable cut quality. Simultaneously, additional discounts may apply due to poor cut quality or undesirable characteristics.

Color

The most valuable white diamonds have no color; more accurately, they are "colorless" with virtually undetectable hue and saturation. In contrast, the hue and saturation intensity determines a fancy-colored diamond's value. Under those circumstances, a white diamond with a noticeably yellow tint is worth less than a colorless diamond.

In contrast, a fancy-vivid intense blue diamond commands higher prices than a pale one. Diamond fluorescence also affects diamond prices commanding discounts and premiums depending on the specifics. Fluorescence refers to the glow some diamonds exhibit when exposed to ultraviolet light. This glow can be of varying colors, but we only recommend faint, medium, or strong blue fluorescence.

Clarity

The diamond clarity grades on the GIA grading scale refer to the absence of inclusions and blemishes. The scale consists of six categories, subdivided into two degrees, resulting in eleven specific grades.

The industry standard for diamond clarity grading is 10x magnification. Flawless diamonds are at the top of the scale and command the highest prices because they are extremely rare. In contrast, it's possible to see inclusions with the naked eye in lower-clarity grade diamonds.

Most people prefer eye-clean diamonds requiring magnification to identify the inclusions. That means diamonds with VS2 clarity or higher, although an exceptional SI1 clarity diamond might work depending on your vision. However, the diamonds' sparkle factor also affects your ability to locate inclusions, making cut quality even more essential.

Cut quality

In our experience, a diamonds' overall cut quality has the most influence over light performance and the sparkle factor. Some 4Cs literature mistakenly refers to Cut as Shape, which relates to the stones outline. Whereas gemological laboratories, such as the GIA, use Cut to describe specific proportions combinations and the consistency of facet structure.

A round brilliant cut diamond with our recommended proportions reflects more light and a virtual balance of brilliance and dispersion. In contrast, a poorly cut diamond may seem dull or lifeless, regardless of its color or clarity rating.

Consequently, it takes up to 4X longer to polish a Hearts and Arrows Diamond than a standard ideal-cut diamond. However, H&A Diamond prices vary due to cut-quality and optical precision variances. That's why ASET and H&A Scope images are essential for determining light performance and value.

Conclusion: Multiple factors affect diamond prices beyond the 4Cs, including shape, market conditions, and technological advancements.

Will diamond prices go up or down in 2023?

Several factors influence global diamond prices, not the least of which is economic conditions. The rise of digital platforms, changes in consumer behavior, and the impact of lab-grown diamonds are slightly less obvious factors. This article addresses these factors and expands your understanding of loose diamond prices and the market.

Economic growth: We like to say that a rising tide floats all boats, and that's certainly true of the diamond market. The demand for luxury goods, such as diamonds, typically increases during economic prosperity. Similarly, demand usually decreases during economic downturns. However, it doesn't lead to lower prices because the cutters tend to shelter their inventory and wait for an upturn.

Digital platforms: E-commerce continues transforming the diamond industry by enabling its expansion into global markets. It also lets consumers compare prices and quality from various sellers in real time. Traditionally, competition puts downward pressure on prices only for generic goods, not necessarily high-performance diamonds.

Changes in consumer behavior: Multiple shifts in perspective affect the industry, including an increase in non-committed relationships. Simultaneously, increasing awareness of ethical sourcing and sustainability influences buying decisions. Many seek ethically sourced or lab-grown diamonds, affecting natural diamonds' demand and price.

Lab-grown diamonds:

Lab-created diamonds are "real diamonds" grown under laboratory conditions from a "diamond seed" or wafer. Lab-grown diamond prices continually reduce due to ongoing technological advancements. Consequently, this subjects natural diamond prices to additional pressure as some consumers see lab-grown diamonds as affordable and ethical alternatives.

In contrast, a segment of people values the rarity of natural diamonds, which increases their value. Under those circumstances, it's essential to evaluate lab-grown and earth-mined diamond prices separately. It's equally important to acknowledge that price differences are not linear. Multiple and hidden intricacies may contribute to a price difference.

Major diamond mining companies: It's also important to acknowledge that mining companies like De Beers, Alrosa, and BHP Billington influence the market. In other words, they can adjust the volume of distribution (diamond supply) to control diamond pricing globally. Similarly, high-volume members of the diamond trade can hold back or release large quantities of inventory for the same purposes.

Market Insights 2023

This year continues to be challenging for the diamond industry, which is still reeling from the effects of COVID. Understanding the impact of the natural rough diamond supply and lab-grown competition is essential.

Multiple elements will shape the industry and affect retail and wholesale prices. The rough diamond supply remains crucial due to global conditions and supply chain interruptions. For example, sanctions against Russia for the Ukraine War affect a 33% share of global production.

Industry sources estimate current global reserves to be around 1.2 billion carats. However, there are concerns about future supply as mining companies face various challenges. Meanwhile, the exploration race continues to discover new rough diamond deposits.

In contrast, the lab-grown diamond segment is experiencing rapid growth and innovation. Lab-grown diamonds, created through technological processes, offer consumers an alternative to natural diamonds. However, this segment faces its own set of challenges, such as consumer perception and acceptance.

While lab-grown diamonds are more affordable and ethically sourced, there is still hesitation among buyers who traditionally associate diamonds with being naturally formed. Another significant factor influencing the diamond market in 2023 is a potential shift in consumer behavior toward lab-grown diamonds.

Consumers may increasingly opt for lab-grown diamonds over their natural counterparts as sustainability and ethical considerations gain prominence. This shift could pose opportunities and challenges for the industry as it adapts to changing consumer preferences.

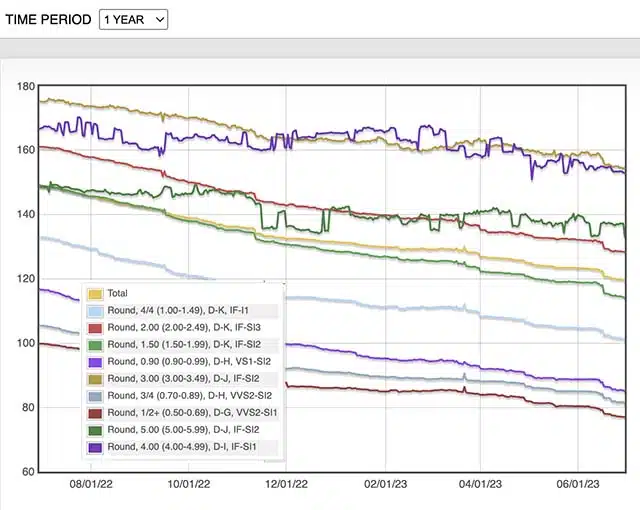

Diamond Price Index, January 2022.

Current market conditions

The current market depends on the natural diamond supply and prices. There are also lab-grown diamond segment challenges and possible shifts in consumer behavior.

Under those circumstances, industry players must carefully track these factors and strategically navigate the changing landscape to stay ahead.

Many diamond traders were speculating on 2022 price increases and inflated prices by withholding inventory. The price decreases occurring now reflect the market adjusting back to its baseline.

2023 Diamond Prices Returning to Baseline.

IDEX and Rapaport Trading Platforms

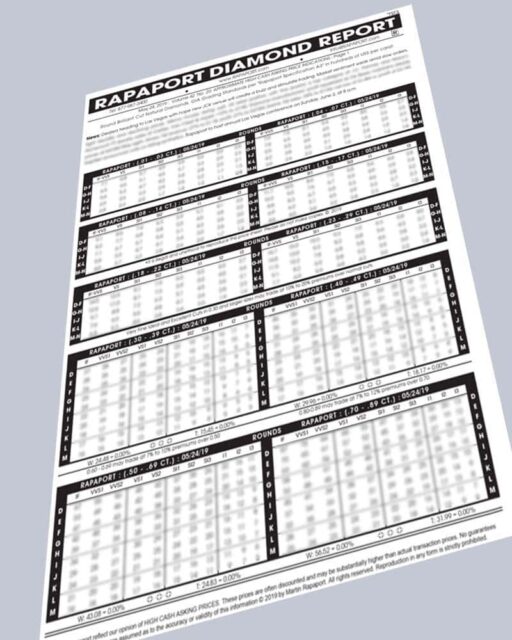

The industry relies on multiple listing services, such as IDEX and Rapaport, to trade diamonds globally. In addition to being a trading platform, these services publish weekly diamond price reports based on wholesale prices.

Both reports offer valuable insights that trade members use as the basis of diamond valuation. However, it's essential to remember that these reports are guides and not definitive pricing tools. Many factors influence retail diamond prices, including brand, craftsmanship, design, and local market conditions.

IDEX is the International Diamond Exchange. It's an online diamond trading platform enabling diamond cutters and wholesalers to list diamonds for sale. The IDEX Diamond Index publishes prices based on actual transaction prices on the network.

The Rapaport Group operates one of the largest and most widely used trading platforms. They also publish the Rapaport Diamond Report, which provides price-per-carat guidelines based on wholesale high asking prices.

Diamond trade members generally use the Rap Sheet as a pricing benchmark when trading. However, actual transaction prices can vary dramatically from the published PPC based on cut quality, fluorescence, and extent of the inclusions.

Rapaport Diamond Price Report.

Natural versus lab-grown diamond prices

Origin is the primary difference between natural and lab-grown diamonds. The two options are virtually identical for all other intents and purposes. Natural diamonds form deep within the Earth's mantle over billions of years. In contrast, creating lab-grown diamonds under controlled conditions takes only a week or two.

One of the most significant differences between natural and lab-grown diamonds is their pricing. Lab-grown diamonds typically cost a fraction of natural diamond prices. That's because the production process allows for more cost-effective manufacturing, making lab-grown diamonds more affordable.

In recent years, lab-grown diamonds have gained popularity due to their low cost and ethical considerations. They are more environmentally friendly because they do not require mining and have a lower carbon footprint. Additionally, lab-grown diamonds offer a wider range of fancy colors not commonly found in natural diamonds.

The type of diamond you choose ultimately depends on individual preferences and priorities. Traditionally, natural diamonds hold their value and are admired for their rarity. In contrast, lab-grown diamonds offer a more budget-friendly option without compromising on beauty or quality.

Online versus jewelry store diamond prices

Actual diamond prices vary throughout the jewelry industry, and getting a fair price can be challenging. There are hundreds of thousands of brick-and-mortar and online stores to choose from, many of which offer the same virtual inventory. In that case, the difference between an expensive diamond and a fair deal is vendor-specific.

Comparing prices across different jewelry stores can help ensure you get the best value for your money. However, it’s also important to remember that price should not be the sole determining factor in choosing where to buy a diamond. Other factors such as reputation, customer service, and quality of diamonds should also be considered.

You can make an informed decision by carefully researching and comparing prices from different jewelry stores. Check the lab report number because there can be a huge difference in retail prices from store to store.

Do GIA certified diamonds cost more?

Current diamond prices account for the reputation of the grading labs for accuracy and consistency. The Rapaport Diamond Price List is based on GIA grading standards and discounts for other diamond grading labs. In that case, it's essential to know that diamond manufacturers, online diamond retailers, and jewelry stores use the Rap List guide for carat prices.

Carat price increases or decreases are published in the Rap Sheet Thursday nights at midnight. The diamond price guide will reflect any wholesale difference in diamond prices at that time. Remember that it reflects average price ranges across a broad range of characteristics, and there are hidden additional factors.

For example, a near-colorless diamond with a black inclusion or yellow tint costs less than one without those characteristics. Likewise, a poorly cut diamond costs less than one with an excellent grade due to labor costs. That's why it's essential to ensure that your diamond-buying process compares apples to apples and not broad categories.

Online diamond merchants

James Allen and Blue Nile are two well-known retailers with impressive market share. Both offer a wide selection of diamonds and a broad selection of engagement rings. Consequently, Signet Jewelers owns both companies, and Kay Jewelers, Jared, Zales, and many others.

That organization's sheer diamond buying volume encourages extremely competitive pricing strategies. However, they're not the only game in town, and Brilliant Earth also benefits from significant venture capital.

Brian Gavin and Whiteflash are renowned for their hearts and arrows super ideal cut diamonds. Their diamonds cost more due to the labor costs necessary to create a higher degree of optical precision. However, the difference in light performance and the intensity of the sparkle factor is worth it. You owe it to yourself to check them out if you're diamond shopping.

These vendors also offer various categories of diamonds, including lab-created and fancy shape diamonds. Remember that lab-grown diamond pricing is subject to the same influences as natural diamonds. Consequently, the devil is in the details in the broader market of virtual diamonds.